Hello friends, and Welcome to the blog! If this is your first time, I’m glad you stopped by, and I hope you consider subscribing.

If your already part of the family … Welcome back.

Happy Wednesday friends. I hope everyone is doing well, and you’re having a great week so far.

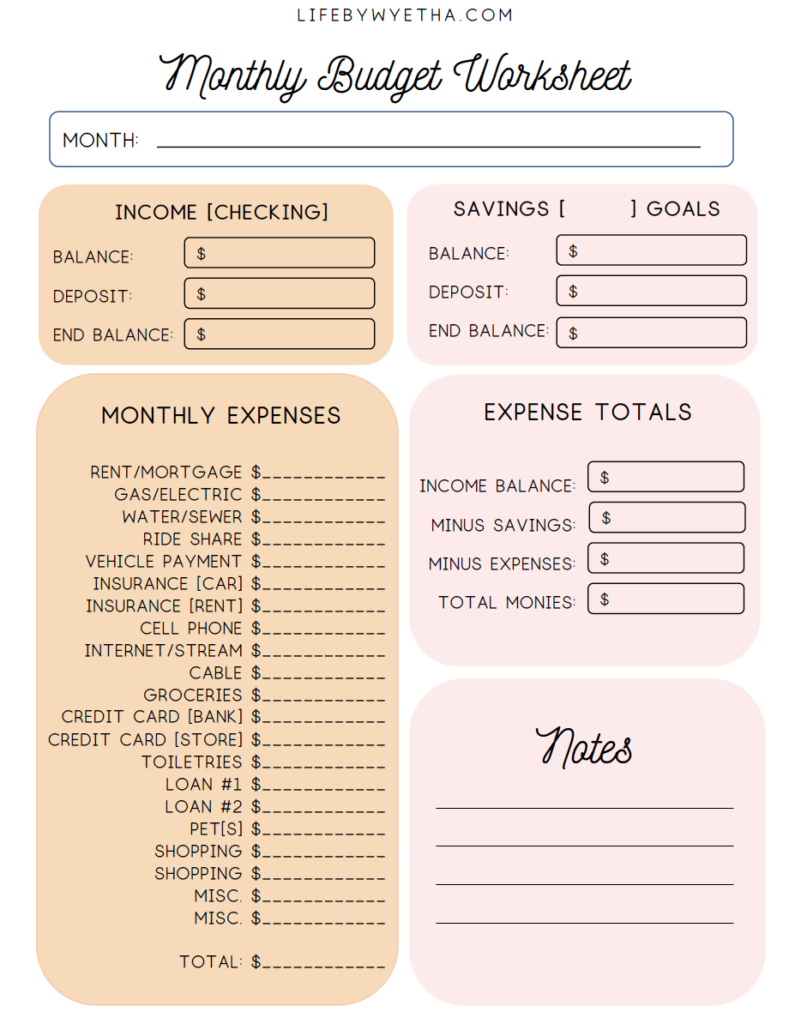

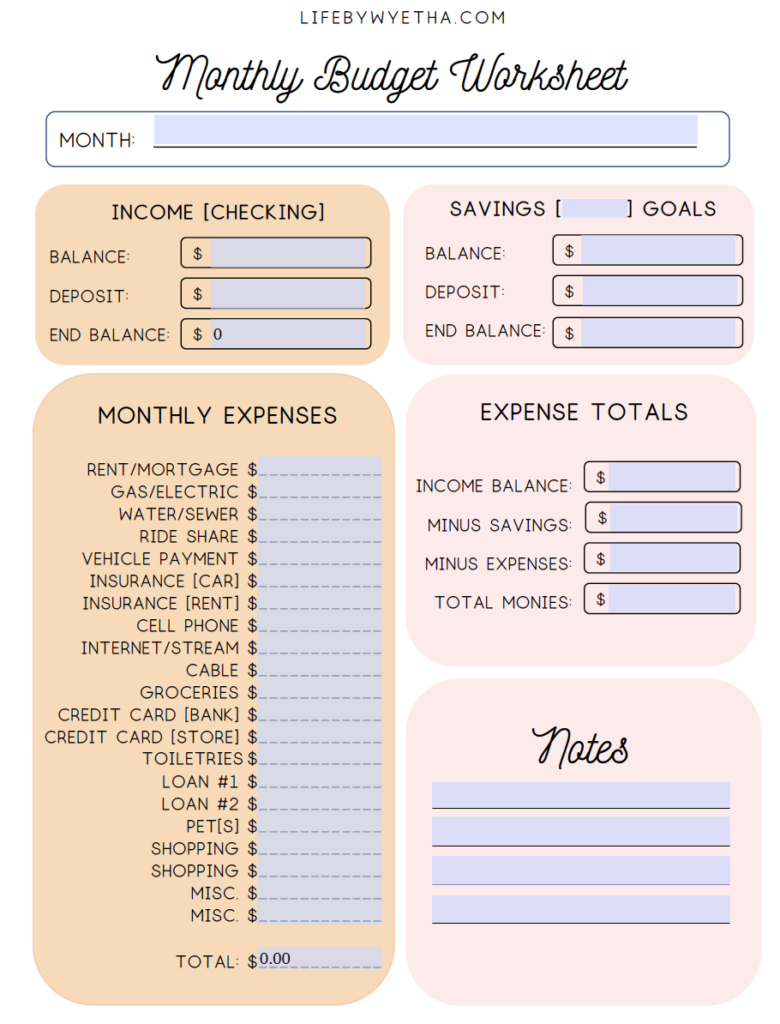

Today I’m talking a little bit about the Budget Expense template I created and wanted to share with everyone.

This can be filled out in Adobe. Only the INCOME, MONTHLY EXPENSES, and SAVINGS field will automatically calculate.

Pin This Image!

This form can be printed off and filled in.

This form can be printed off and filled in.

— This post contains affiliate links —

Current Budget

I won’t say that my spending is out of control, but it’s out of control. The amount of money I’ve spent on basic toiletry items and groceries borders on ridiculous.

Last month I was done, so I created a spreadsheet (one of several) to track where my money was going. I spent a day going over my bank statement and comparing it with receipts and what I actually spent and let’s just say OMG. My money was just ?.

What Happened?

The bulk of my money is going to savings and CC debt. I’m over the moon with the aggressive savings plan I created but underwhelmed at my CC debt. My reasoning has always been … I got myself into this so I can get myself out of this. I didn’t factor finance charges and a worldwide pandemic into the mix.

First off, I was going about the whole “snowballing your payments” all wrong. It’s hard to keep track of paying every credit card a little more, and you can’t make any headway going about it like that.

So through reading, webinars, and other information, I’ve found that the most effective way to snowball and reduce that debt is to just focus on one credit card at a time.

My Game Plan

Let’s give an example of 3 credit cards:

-

- Credit Card #1 … BAL $500 / Minimum Payment $40

- Store Card #2 … BAL $300 / Minimum Payment $25

- Bank Card #3 … BAL $400 / Minimum Payment $35

Originally I thought that paying more than the minimum payment was a good idea … because it is. However, this is where I went wrong.

This is what I was doing:

-

- Credit Card #1 … BAL $500 / Minimum $40 / My Payment $80

- Store Card #2 … BAL $300 / Minimum $25 / My Payment $50

- Bank Card #3 … BAL $400 / Minimum $35 / My Payment $70

While this seems like a good plan, this option would take longer overtime to pay off each one. It’s also stressful because you feel like your working to pay credit cards.

This is what I should have been doing:

-

- Credit Card #1 … BAL $500 / Minimum $40 / My Payment $40

- Store Card #2 … BAL $300 / Minimum $25 / My Payment $125

- Bank Card #3 … BAL $400 / Minimum $35 / My Payment $35

I should have been taking that extra money to double one credit card ONLY that was the lowest. The idea of the snowball effect is to take your smallest bill and increase that payment, giving your others a minimum payment ONLY. Once that bill is paid you take that extra money and focus on the next smallest bill thus snowballing your payments.

This means that this $300 dollar balance can be paid off in 2 1/2 months vs. a $50 dollar payment that would be paid off in 6 months.

Seems So Easy

I will acknowledge that … yes I’m an adult, but adulting is complicated. It seems so easy but sticking to a budget is easier on paper than it is in real life, because real life $h!t happens. Credit cards are useful in establishing your credit, and helpful in a pinch but “don’t let the smooth taste fool you” (LOL), they can and will get you into trouble if not managed properly. I learned the hard way.

I hope this post is helpful so that YOU don’t have to learn the hard way and you can benefit from my mistakes. Let’s face it, you work hard for your coin, and you want things, and I get what I want when I’ve worked hard for it. However, knowing what you can afford over a period of time will help you in the long run.

Thanks again for stopping by the blog today. I hope this post was helpful and informative. Let me know if I can customize or change the expense forms so that they are more helpful. — Peace —

3 thoughts on “Taming The Debt: My Expense Template”